In Sage X3, user can create sales credit note against the Sales Invoice transaction. This can be done as per the selected date of invoice & credit note creation date. In this customization we are going to give the pop up message at the time of the credit note creation against particular Sales Invoice. As per the GST rules, whenever material is returned by the customer to supplier for any specific reason, all taxes are collected by the supplier can be reversed if return is done before 6th month of next fiscal year, if credit note i.e. return are done after 6th month of the next financial year then taxes cannot be reversed. So in this case we will provide the pop up message at the time of creation of credit note against invoice if credit note is done after 6th month of next financial year.

Let us take an example, if current fiscal year is 2017-18, user has created one sales invoice transaction on 30th June 2017, now if customer wants to return the material in next fiscal year i.e. 2018-19 in the month says August 2018 the system will allow to making a credit note entry against that particular Sales Invoice. But if Credit Note will be done after September 2018 then system will give a pop up message as “Since transaction older than 6 months of the next financial year tax credit should not be taken, kindly review the Tax applied on the document”. After displaying this message, user can click on “OK” button and can create the credit note transaction as this is just a warning message.

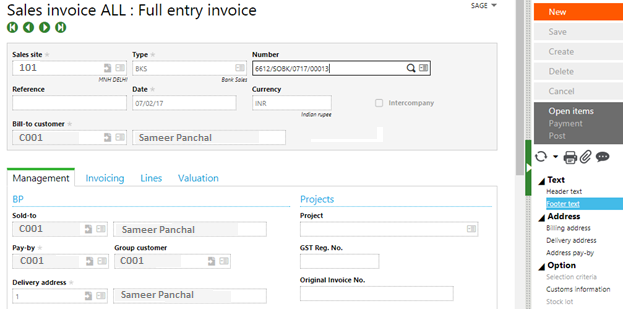

Create new Sales Invoice, select Sales site, bill to customer, add detail line products with taxes on 2nd July 2017 and post this particular entry, Go to Sales–>Invoices–>Select all full entry invoice, refer below screenshot:-

New Stuff: How to exclude Components on a Work Order in Sage X3

![[Sample Sales Invoice]](https://www.greytrix.com/blogs/sagex3/wp-content/uploads/2020/10/Sample-Sales-Invoice.png)

Now go to Sales–>Invoices–>select all full entry credit, select sales site, bill to customer, click on select invoice option from left side on screen, select above invoice no, change date as 17th November 2018, click on create button. Message box will get pop up i.e. “Since transaction older than 6 months of the next financial year tax credit should not be taken, kindly review the Tax applied on the document”. Refer below screenshot:-

![[Warning message on credit note]](https://www.greytrix.com/blogs/sagex3/wp-content/uploads/2020/10/Warning-message.png)

Now user will click “OK” button on pop up message and then system will allow to create the above transaction.

With the help of above customization, user will know whether they have created the transactions as per the specific fiscal year or not. This customization can be done in other screens also as per the client’s specific requirements.

About Us

Greytrix – a globally recognized and one of the oldest Sage Development Partner is a one-stop solution provider for Sage ERP and Sage CRM organizational needs. Being acknowledged and rewarded for multi-man years of experience, we bring complete end-to-end assistance for your technical consultations, product customizations, data migration, system integrations, third-party add-on development and implementation competence.

Greytrix caters to a wide range of Sage X3, a Sage Business Cloud Solution, offerings. Our unique GUMU integrations include Sage X3 for Sage CRM, Salesforce.com, Dynamics 365 CRM and Magento eCommerce along with Implementation and Technical Support worldwide for Sage X3. Currently we are Sage X3 Implementation Partner in East Africa, Middle East, Australia, Asia, US, UK. We also offer best-in-class Sage X3 customization and development services, integrated applications such as POS | WMS | Payment Gateway | Shipping System | Business Intelligence | eCommerce and have developed add-ons such as Catch – Weight and Letter of Credit and India Legislation for Sage X3 to Sage business partners, end users and Sage PSG worldwide.

integrations include Sage X3 for Sage CRM, Salesforce.com, Dynamics 365 CRM and Magento eCommerce along with Implementation and Technical Support worldwide for Sage X3. Currently we are Sage X3 Implementation Partner in East Africa, Middle East, Australia, Asia, US, UK. We also offer best-in-class Sage X3 customization and development services, integrated applications such as POS | WMS | Payment Gateway | Shipping System | Business Intelligence | eCommerce and have developed add-ons such as Catch – Weight and Letter of Credit and India Legislation for Sage X3 to Sage business partners, end users and Sage PSG worldwide.

Greytrix is a recognized Sage champion ISV Partner for GUMU Sage X3 – Sage CRM integration also listed on Sage Marketplace; GUMU

Sage X3 – Sage CRM integration also listed on Sage Marketplace; GUMU integration for Sage X3 – Salesforce is a 5-star rated app listed on Salesforce AppExchange and GUMU

integration for Sage X3 – Salesforce is a 5-star rated app listed on Salesforce AppExchange and GUMU integration for Dynamics 365 CRM – Sage ERP listed on Microsoft AppSource.

integration for Dynamics 365 CRM – Sage ERP listed on Microsoft AppSource.

For more information on Sage X3 Integration and Services, please contact us at x3@greytrix.com, We will like to hear from you.